Executive Summary: Investors who focus on accumulating shares are almost always better off than those who focus on current account value. The wealth you eventually accumulate will likely be correlated with how well you internalize this critical stock market concept. It’s incredibly difficult and requires a lot of discipline, but it will pay off—big time.

In a bear market, you might feel like you’re losing money, but the truth is, your current account value is simply down. You didn’t lose any shares. The units of assets you own didn’t disappear. And you’re not losing any of those assets unless you sell those shares at a loss.

Remember, investing is not based on getting the timing right—you’re not trying to maximize the current value of your accounts at all cost. Even during declining periods, accumulating shares is always the long-term goal—whether it’s 20,000 shares, 1,000 cows, 18 paid-off rental properties, or five fully-functioning practices with associates––it’s all about asset accumulation.

To reach your long-range objectives when markets are up, down, or sideways, stay focused on accumulating more shares. Think of stocks more like cows. It’ll mooove you in the right direction.

Disclaimer: You might actually have a poorly constructed portfolio (not diversified properly and concentrated in narrowly focused assets or individual stocks that don’t reflect good investment science). The following advice assumes your portfolio is already in decent shape (properly diversified, appropriate costs, and isn’t making bets on any particular sector or style of investing). If you’re unsure about the quality of your portfolio, please seek a second opinion. This article is not intended to pacify you into holding a poorly performing portfolio. It’s intended to reinforce positive behaviors for those who have a fundamentally sound portfolio.

If you’ve ever gotten up in the morning, looked at your accounts, and been angry at the stock market, then this message is for you. I’ve gone back to my roots to create an analogy that I think can really help you protect your hard earned cash.

For just a few minutes, I want you to forget everything you think you know about stocks. Let’s just meander out West together to the place where John Wayne learned how to build wealth the old-fashioned way—on the ranch. With cows. Holsteins to be exact. Your run of the mill Springers. And these cows are going to change your life. But, first—let’s review some of the half-truths your brain has told you about your investments at some point in your life.

What You Think, at Least Sometimes

Imagine you have an account of $250,000. You invest $5,000 one day. A few days later you expect your account to be worth at least $255,000. But it’s not. It’s worth $240,000. “Hold on,” you’re thinking. “I just put $5,000 into my account, and now, a few days later, it’s down $15,000? This sucks. I put in five grand and I lose fifteen grand. This game is rigged.”

When accounts go down (and they do for all of us), we start telling ourselves things that aren’t true. Things like:

- “I saved a ton of money but the market basically wiped it out.”

- “My entire year’s worth of savings just disappeared.”

- “I would have been better off not investing money at all this year.”

- “I gotta stop investing until things get better.”

- “I’m just going to stay in cash and ride this out.”

These emotions are often stronger for people with larger balances (depending on their level of experience). When the losses become closer to the amount you spend personally each year, they become much harder to endure.

For example, if you spend $100,000 per year for basic living expenses, you might not stress a decline from $250,000 to $200,000. But you’ll feel a lot more pressure when your account drops from $1,500,000 to $1,200,000. Both losses are 20%, but one is a $50,000 loss, and the other is a $300,000 loss—more than 3x what you spend in a year.

Until you gain some understanding of how investing (when done properly) works, this kind of thinking puts your portfolio at risk of underperformance, or even worse, major losses.

I’m not saying you shouldn’t feel these things. Investing isn’t easy—it’s incredibly difficult and requires a lot of discipline. It’s frustrating to feel like your money is disappearing; especially when it’s so hard to earn it in the first place. But the truth is, your money is not disappearing, and it’s super unhealthy to tell yourself that you’re losing money during a decline.

The Case For Accumulating Cows

After working with my grandpa for a few years on his cattle ranch, I learned a lot about cows. I was in charge of feeding, irrigating their pasture, and occasionally  dragging birthing cows out of the Snake River so they wouldn’t die. Don’t ask me why the cows decided that water-birthing was a good idea, especially in a river. But that’s another story.

dragging birthing cows out of the Snake River so they wouldn’t die. Don’t ask me why the cows decided that water-birthing was a good idea, especially in a river. But that’s another story.

I want you to think of investing in the stock market like accumulating a nice herd of cows. It’ll make more sense.

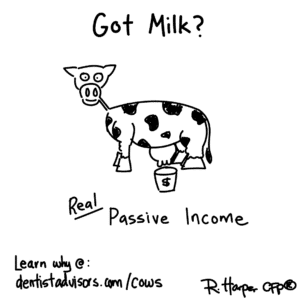

Let’s imagine that to reach your personal financial goals, you need to build up a herd of 1,000 cows. At 1,000 cows, you’ll be able to withdraw passive income from your herd and live forever without having to work again. That’s your goal—1,000 cows, and you’re done. You’ll be rich…in cows.

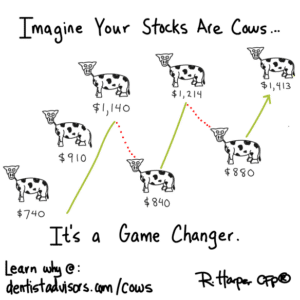

You jump on DairyDealer.com and pick out your favorite Holstein Springer. Prices change a lot based on supply and demand for milk. These Holstein’s can range between $750 – $1,800+ per cow. Your plan is to buy five cows per month to build your 1,000 cow nest egg. In less than 20 years you’ll be all cowed up.

Now, you’re going to pay different prices for each cow each month, but over time the prices should average out. Because of your long-range goal to accumulate 1,000 cows, you don’t really care exactly what you pay per cow. You just need a steady plan to get there. If you can just get to that critical mass of 1,000 cows, you’ll be able to kick off the passive income you need to support your lifestyle…and never have to work again.

But What Happens When the Price of Cows Goes Down?

Let’s move ahead a few years. You now have about 220 cows. As you’ve come to expect, sometimes the price for cows goes up, and periodically the price of cows drops. This month there’s a pretty steep decline in cow prices due to an oversupply of milk from some aggressive dairymen in Idaho.

Oh well, that makes this month’s purchase cheaper too—and you’re five cows closer to the 1,000 cows you need. So you buy another five cows bringing the total to 225 cows. It just so happens that this month your financial controller and Heifer herder named Harrison shows up to give you a financial overview of your inventory.

Here’s his appraisal: Last month you had $250,000 worth of cows (220 cows at $1,136 per cow). But this month cow prices dropped to $1,090 per cow. Even when you include the five cows you purchased this month, bringing your total up to 225 cows, you technically only have $240,000 dollars worth of cows. Bottom line, it’s a $15,000 loss from last month, even with the five new cows.

You’re In The Business of Accumulating Shares of Assets

Now I’ve purposefully used the same numbers for my cow analogy as I did for my personal investment account example at the beginning of the article. In both cases, an investment of $255,000 dropped to $240,000. But does investing in “cows” feel different than the “stock market?” It shouldn’t, but for most people it does.

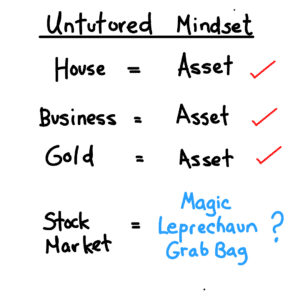

To a lot of people, the stock market feels like a bet. A floating “bet” if you will. It feels like a place where you throw money, and pray that it goes up. And when it goes down, you’re a sucker—you got taken advantage of by the “system.”

Cows look, feel, and literally smell like assets. They’re easy to count, and every month you know what you’re buying, and perhaps most importantly, you have a tangible goal of 1,000 that you’re trying to hit.

But did you really LOSE any money in either example?

Cows are like just like shares of stock. Whether you’re buying shares of a mutual fund, like the U.S. stock market index, or purchasing specific numbers of cows each month, you’re accumulating assets. You own something that has a promise of future income and appreciation.

Sometimes the prices of those stocks (cows) are cheaper than average, and sometimes they are more expensive than average. It’s incorrect to think about your money as being “lost” just because the current price of your assets is down.

Exploiting Your Emotions

There are a lot of people who want to take advantage of your emotions during a market decline, and they often manipulate you into doing stupid things during declining periods. TV commercials and salespeople of all shapes and sizes show up and try to convince you to stop investing in this “casino”—it’s a rigged system! Take some action. Buy something safe, something tangible, something you can wrap your arms around. Gold, property, cash-value life insurance, annuities, or dozens of other options.

Whether you’re accumulating 1,000 Cows, 20,000 shares, 10 paid-off rental properties, or five fully-functioning practices with associates, these are just assets. And you’re buying them at different prices throughout your life. Whatever your choice of assets, you’re in the game of accumulating those units.

When it comes to the stock market, you’re purchasing shares each month. And that’s not the same as losing something. You never lose money when you buy shares of the market unless you sell those shares at a price cheaper than what you paid. As long as you have a long enough holding period (I’d recommend no less than 10 years), your probability of success is very high. I’d recommend a similar holding period for any asset you purchase.

The real trouble comes when investors start thinking of their accounts as a bet, or a game. We call it market timing—trying to get in and out of the stock market as prices fluctuate. DO NOT think about your investments this way. As John Wayne himself said:

“Young fella, if you’re lookin for trouble, [the market] will accommodate you. Otherwise, leave it alone.”

If you really were in the cattle business, would you try to sell your entire herd, and repurchase your entire herd as prices fluctuate? Of course not. That would be a nightmare, require a ton of effort, and you’d miss out on important milking that generates income along the way. Stocks are very similar in that they pay out dividends (milk) on a regular basis. When you jump in and out of stocks, you miss the income. Many people sit on the sidelines for years and miss out on dividends and growth as they try to decide the optimal point of re-entry.

If you believe you’re simply accumulating a diversified portfolio of shares over a long period, you’re less stressed. You’re on a more predictable path.

Markets Are Safer Than Cows

When you buy shares of the entire market, you’re actually buying something more diverse and predictable than cows. It’s also more liquid and much less expensive to manage.

Shares of stock not only have a higher expected return than commodities like cattle, but they’re also very liquid. That means you can convert small quantities of stock to cash instantly, with very little cost. This is a huge advantage for someone who is retired and simply wants to have passive income and fewer headaches.

But this liquidity—one of the greatest strengths of the market—also makes it very dangerous. This liquidity also makes people do stupid things, like jump in and out of the market whenever prices change (with almost zero transaction costs). Selling cows or real estate often comes at a pretty significant effort and a pretty significant cost. So people just don’t do it very often.

When investors look back over their lifetime at their favorite investments, they often compliment their real estate, their businesses, and other assets that were difficult to liquidate and consequently stuck around. Even though those assets appreciate and grow, they often do at a rate of return that is lower (and riskier) than what could be delivered by public stock markets.

Shares of stock are more transparent too. The up and down swings in the market are displayed every day instead of only once a year. Don’t be afraid of the transparency—embrace it.

Real estate, cows, and even small businesses don’t share their appraised values quite as often, so sometimes we view them with more empathy. For example, your rental property (or your cows) could be having a really poorly performing period, but for a variety of nonsensical reasons, you judge them less harshly even if their values are also moving up and down significantly.

Don’t hate stocks just because they are telling you the truth. The volatility and accuracy of stock pricing is an advantage, not something to fret over.

You’re still purchasing cows—only these “cows” are just better. They have higher returning income and growth potential, and they’re more passive to own and operate. They also carry less liability and give you a chance to liquidate and purchase them in small quantities (which is really convenient from a budgeting perspective). And they’re cheaper to exchange. These are all good things.

Conclusion

Your ability to stay focused on accumulating shares of assets (funds, ETFs, or stocks) during tough markets is directly tied to the wealth you will accumulate for retirement.

It’s been helpful to me during difficult financial periods to remember that I’m on a journey to accumulate shares—not a timing or guessing game that depends on when I happen to have purchased my most recent set of shares.

What is actually happening every day in my account is much more like purchasing cows than going to Vegas. When the market declines, I’m stoked to be purchasing things on sale. And when the market increases, I’m stoked that all of my cows are worth more money today than they were worth in the past (which increases my total wealth).

Instead of worrying about the prices for which those shares trade each day, be excited you’re accumulating the ideal number of shares (cows).