Is building cash value in permanent life to borrow against later a good strategy? Learn what assets may offer better flexibility.

Executive Summary

QUESTION:

“I’ve been told I can borrow money against cash-value life insurance tax-free. This seems like a good retirement planning tool, especially since I’m in such a high tax bracket. What do you think?”

Some people mistakenly believe that building up cash value inside of life insurance policy and then borrowing against it is a way to tap into some secret sauce—a strategy for building wealth they couldn’t achieve any other way. Insurance sales techniques like Infinite Banking®, Bank on Yourself®, or LEAP® are popular among salespeople and often promote the idea that life insurance allows you to “be your own bank.”

However, borrowing money against an asset that you’ve paid for with after-tax money is always tax-free, and it’s definitely not a primary reason someone should purchase cash-value life insurance. There are alternative strategies to gain leverage from other assets that offer better loan terms and greater investment flexibility.

You Can Borrow Against Real Estate and other Liquid Investments

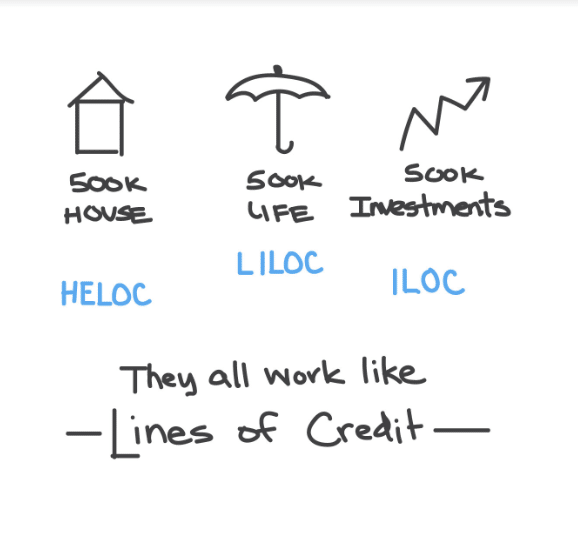

Yes, you can borrow against your cash-value policy. But you can borrow against a lot of different assets—and several alternatives are less expensive, more competitive, and give you more control over your investments.

Think about real estate—a HELOC on a piece of property allows you borrow against the property tax-free and use it for any purpose you choose like retirement income, a completely different investment, or a new electric dog polisher. You borrow the money, pay the interest, and either pay the loan back or keep the debt indefinitely. When you pass away, the remaining equity just passes to your family. Whether it’s a primary residence, vacation property, or commercial building, the outcome is very similar.

Even more closely related, most people don’t realize they can accomplish the same strategy with a regular old investment account. You can purchase ETF’s, and Mutual Funds in an investment account and use them as collateral for borrowing (similar to a house or a life insurance policy). If you’re a conservative, or income-focused investor, you can purchase an actively managed bond fund (which is very similar to what life insurance companies purchase when you give them your money), or if you prefer a less expensive option, you can purchase a bond index fund (municipal, corporate, government, or a mixture.) If you’re a more aggressive, growth-oriented investor, you can purchase more stock indices or mutual funds to seek a higher expected return. No matter your risk profile, you’ll be able to set up a line of credit against your account to use for borrowing in a very similar way to a life insurance policy.

The point to remember here is that although borrowing against cash-value life insurance is possible, it’s not particularly unique. And if you choose to pursue a leveraged strategy similar to those advocated by Infinite Banking®, Bank on Yourself® or LEAP®, you can accomplish similar outcomes less expensively and with more flexibility by using a simple investment account or real estate that you need / already own.

The insurance company is not incentivized to make the loan competitive

If you decide to pursue a leveraged strategy like the options we’ve discussed, you’ll want to make sure you’re getting the optimal rate of return and the lowest borrowing cost. The person who earns the highest return for the level of risk they are taking and borrows at the lowest cost will increase their wealth the most.

When you lend money from a life insurance policy, the odds are not in your favor. The life insurance company controls both the returns on the investment (the bonds, and other investments in the policy) and the rate of interest on the loan they are giving you.

For that reason, it lacks market forces that drive competition. The insurance company knows you can’t just quickly pick up and change carriers. They know that you’re kind of stuck with them as soon as begin the policy. This makes their incentives very different from the real estate or investment account borrowing we discussed earlier.

Essentially, the insurance company holds all of the cards—not you. Not to mention the surrender penalties, fees, and tax consequences are much more difficult to diagnose. One phone call into customer service to navigate your options and you’ll see that there’s another layer of complexity that feels almost intentionally difficult to understand. For this reason, and many others related to the costs and internal return of most life insurance policies, most investors do not feel as comfortable using life insurance as a vehicle for borrowing.

NATURAL MARKET FORCES GIVE YOU AN ADVANTAGE

With the real estate and investment account options, there are some natural market forces at play. You can easily change the location of your accounts without selling any of the underlying investments you own. You just transfer them over to another bank using a direct transfer which doesn’t have any tax consequences at all.

With most life insurance policies, there are significant costs up-front (commissions) that range anywhere from 50% – 140% of the first year premium. Once you pay that kind of cost, you’re emotionally tied up to the carrier and it makes objectivity quite difficult (even though the money is already gone and there is no real justification for staying in a poorly performing asset).

You can also refinance your home loan quickly, and with very little cost as the refinance market is highly competitive. This naturally creates more competition in both the investment and real estate markets when it comes to lending.

For people who want a “safe” investment mix, similar to the conservative mix of bonds (primarily) that the insurance company invests in—why not buy a comparable mix of investments using bond mutual funds that you control, and make the bank or custodian compete for our business by offering attractive loans? They’re your assets, and borrowing against them should be transparent and easy to understand.

Conclusion

Life insurance is not uniquely suited to be a highly-leverageable asset. It’s expensive on the front end—and even with commission-free products there are limited investment options, and limited market forces at play. The insurance company controls the interest rate and the returns that are ultimately available to you.

This strategy used to be a relatively attractive investment (prior to the internet, and the massive availability of credit and investment opportunities to consumers). But as Bob Dylan would advise, “times they are a changin,” and anyone caught up in this strategy in recent years is severely underinformed.