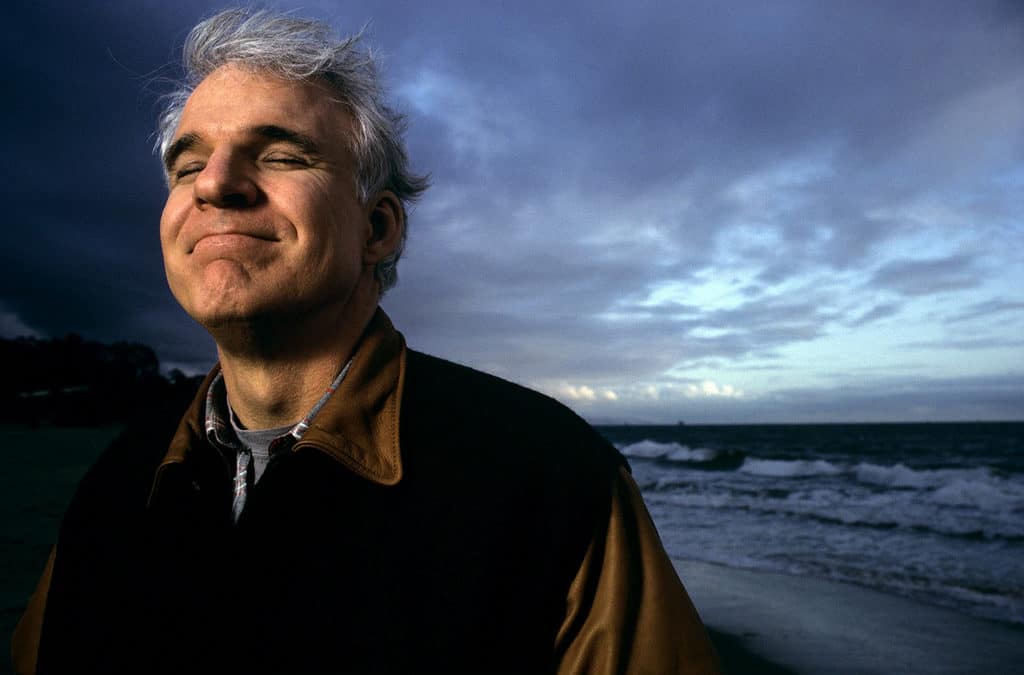

Steve Martin has a few observations about life that can be applied to why you might be struggling with your personal finance.

Steve Martin has made his living making us laugh (and he’s pretty good with the banjo too). I’ve always got a kick out of his little nuggets of wisdom. So I compiled a few of my favorites to help me illustrate some reasons why dentists are different—and why they struggle with personal finance more than other business owners I’ve worked with. I’m hoping this article sparks an idea or two that might help you leverage your opportunity as a dentist to create more wealth.

Martinism #1: “I’ve got to keep breathing. It’ll be my worst business mistake if I don’t.”

Before I dive into the financial stuff, I just want to make sure that we’re on the same page with what really matters—you, your life, and your health. A good financial plan better leave you happy, healthy and satisfied with your life. If it doesn’t do that, it’s falling short. We don’t work hard just to accumulate wealth. We work to support a life that leaves us feeling incredibly fulfilled.

One of my favorite Dalai Lama quotes says: “[Man] sacrifices his health in order to make money. Then he sacrifices money to recuperate his health. And then he is so anxious about the future that he does not enjoy the present; the result being that he does not live in the present or the future; he lives as if he is never going to die, and then dies having never really lived.”

So take care of yourself! And get your financial plan in order so you can prioritize your life and keep breathing easy.

Expert Tip: Spend meaningful time off—and disconnected from—work by taking at least four vacations per year with people you love.

Martinism #2: “Finally, we do become wise, but then it’s too late.”

ADA research has some eye-opening news for dentists—the average age for retirement is now 69,1 while the average American is retiring six years earlier at 63.2 There’s nothing wrong with working into your late 60’s, or even beyond (especially if dentistry is a fulfilling part of your life). But let’s make sure you get to decide when you’re going to hang up the drill.

In advising dentists across the country, I’ve been surprised to see how many dentists are dissatisfied, working into their late 60’s and early 70’s because they haven’t saved nearly enough to support the lifestyle they wish to maintain. I’m worried that too many dentists are forced to keep working for too long.

Dentistry is a lot more rewarding when you don’t have to do it. And good financial planning isn’t a race to the earliest retirement—it just makes work optional at an earlier age. In other words, it puts you in control of the decision.

Expert Tip: Build your personal net worth to at least 30 times your personal annual spending by the time you reach age 60—so work is optional at an early age. Then work as long as it makes you happy.

Martinism #3: “I love money. I love everything about it. I bought some pretty good stuff. Got me a $300 pair of socks. Got a fur sink. An electric dog polisher. A gasoline powered turtleneck sweater. And, of course, I bought some dumb stuff too.”

I’ll be the first to admit that I squander a little money every once in a while on some pretty dumb stuff. Dentists are among the highest earners in the country, and consequently, they’re also some of the biggest spenders. When you make more, you spend more. And consequently, dentists need a larger retirement portfolio to support the lifestyle they want.

You spent years in dental school living frugally while your peers started careers, bought new cars, homes, and luxury items. Not you. You had your nose to the proverbial grindstone, studying and passing your boards. It required big sacrifices. And now you get to enjoy the payoff. You now have more financial flexibility than your peers, which leads to better real estate, cars, vacations, entertainment, and nights out.

But be warned, as you plan for retirement it will be harder than you think to cut back and spend less. The more you earn, the larger the portfolio you need to replace your standard of living.

Expert Tip: Have someone else help you track your personal spending using an online spending tracker. Report to them how your personal spending is changing each year. Whatever you spend, make sure you can still save at least 20% of your gross income. Set up an automatic draft each month and get it out of your practice checking account and into your investments. As long as your savings rate is healthy, spend away!

Martinism #4: “Always do business as if the person you’re doing business with is trying to screw you, because he probably is. And if he’s not, you can be pleasantly surprised.”

Your high income makes you a target for commission-hungry financial professionals. If you didn’t notice the bulls-eye that came with your degree, believe me, others did.

Even the average GP sits among the highest income earners in the country. And even more, it’s a steady, predictable income—like sweet honey to someone who wants to make money off what you do.

Financial products are not financial plans. And the role of your financial advisor is not to be a salesperson. Investing should not be exciting, or feel like a quick fix. Like legendary economist Paul Samuelson says, it should feel more “like watching paint dry or watching grass grow.”

Expert Tip: Work with a fee-only fiduciary advisor; preferably someone with extensive experience with dentists. If your existing advisor isn’t fee-only, ask them to explain why. Don’t be afraid to walk away from an advisor even if they are a family member or long-time friend. Your financial wellness (and health) may be in jeopardy.

Martinism #5: “Before you criticize a man walk a mile in his shoes. That way, when you do criticize him, you’ll be a mile away and have his shoes.”

Most people just don’t know what it’s like to be a dentist and a business owner. You fit on two sides of a spectrum. You’re the entrepreneur who gets a business up, running and growing. And you’re the clinician—the one with the professional skills needed to bring money into the practice.

You’ve got to think about debt, expansion, real estate, recruiting, retention, the right mix of insurance and fees for your practice, and implementing the right marketing strategy to attract and retain patients.

But to complicate things, you’ve also got to think about the service experience you’re delivering to patients, improving your clinical competency, scheduling, flow, team CE, supplies, equipment, and countless other challenges to running a dental practice.

Expert Tip: The bottom line is, while you’re trying to be a great clinician, and a great business owner, your financial planning decisions are often neglected until it’s too late.

Martinism #6: “It’s not what you know, it’s what you think you know.”

Most people think more money would make life easier. But as you know, and as the late Notorious B.I.G. reminds us, “Mo’ Money Mo’ Problems.” Making a high, consistent income also comes at a price. And that price is usually a lot of debt, stress, responsibility, and even less time than you had before.

Most dentists didn’t get into this job with the sole intention of making more and more money. They wanted to feel like they had a good career, a great job, and a nice work-life integration.

Because of how stressful and busy things can be, a higher income can mask the urgency of financial planning. You know how it goes. Things inside your practice that get done are often the ones that scream the loudest – like an emergency patient. Other stuff just has to wait most days.

Financial planning falls into what Steven Covey calls the “important, but not urgent” group of daily tasks—things most people just kick down the road, even though they’re very important. They’re often neglected until a lot of time has passed. And then you end up having to fix stuff retroactively, which isn’t easily done, especially when there isn’t as much time left for your investments to grow.

Martinism #7: “I thought yesterday was the first day of the rest of my life, but it turns out that today is.”

The earlier you start, the more value you obtain from your financial plan. Time is an investor’s best friend. Your financial picture is surprisingly complex, with opportunity costs related to debt, insurance, savings, retirement, taxes, spending, real estate, profitability, investments, liquidity, and practice equity. Making adjustments to each of these areas will have a positive, domino effect on other parts of your financial plan.

Today is the first day to implement a comprehensive financial plan that incorporates everything in your financial life. And the faster you make positive adjustments, and the earlier you start, the greater your wealth will grow.

Good luck—you have one of the highest paying and best jobs in the country. Enjoy the journey and make every day count.

- https://www.thebalance.com/average-retirement-age-in-the-united-states-2388864