Bitcoin is up.

If you didn’t know that, then you must not have anyone in your life who owns Bitcoin because they’ll be the first to let you know about it.

As I’m writing this, the price of one Bitcoin is a whopping $95,778, an all-time high for the cryptocurrency. And has been flirting with the fabled $100,000 mark for the past week or so.

Since the presidential election just a few short weeks ago, Bitcoin is up over 40%.

The price of Bitcoin grew 116% in 2024, over 157% since last Thanksgiving, and has risen a massive 480% since Thanksgiving of 2022.

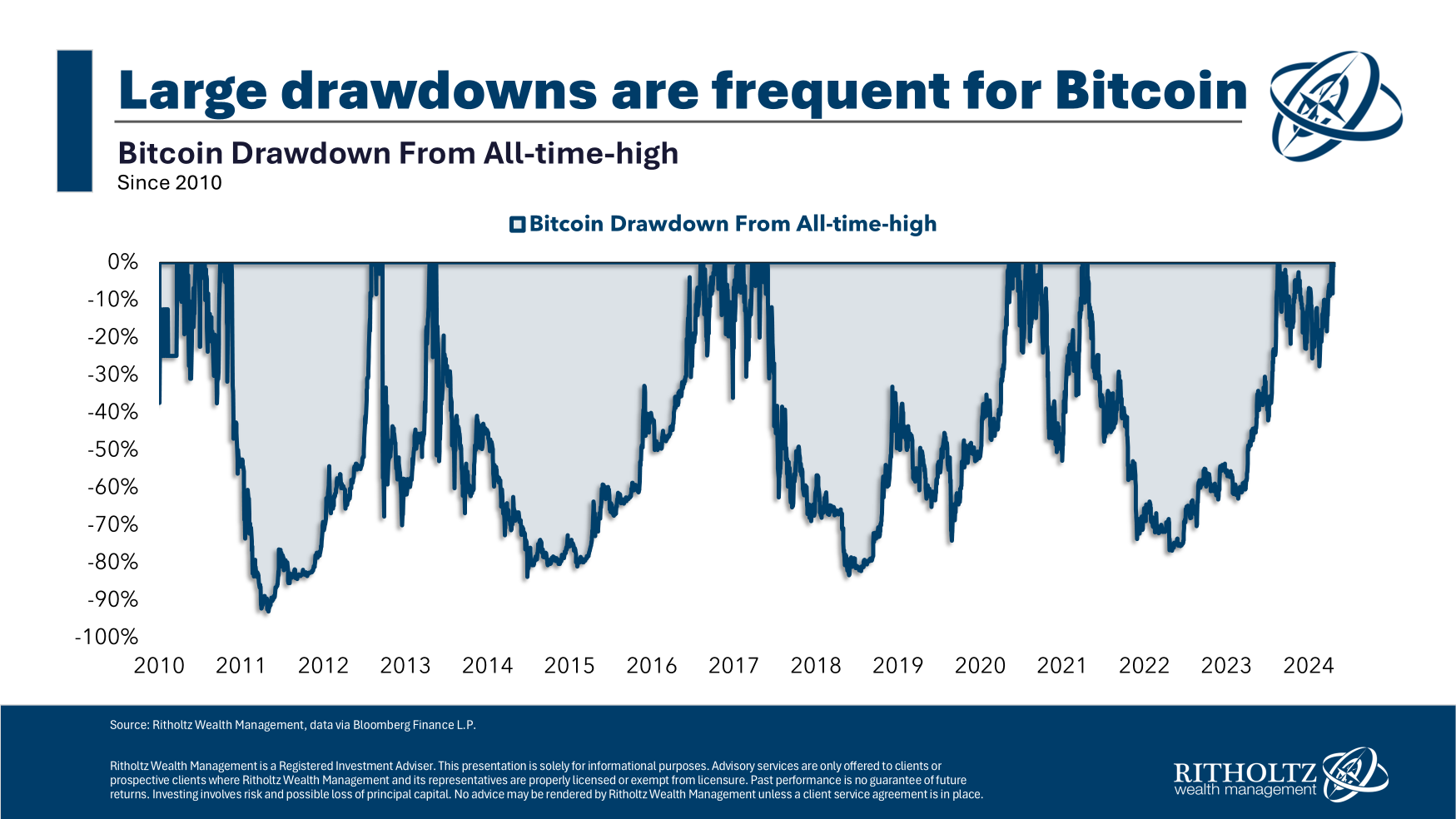

For some context, the reason why the percentage increase from the end of 2022 is so large is because Bitcoin was coming off of a huge drawdown. From November 2021 to December 2022, the price plummeted over 74%.

But this is how Bitcoin has operated. Large drawdowns have been quite common. Since 2010, there have been declines of 90%, 80%, 80%, and 75%:

That’s four Great Depression-esque crashes in 15 years.

So if you account for the massive drawdown in 2022, the returns over the past 3 years are a tad more modest than the mind-boggling numbers I shared above.

Since March of 2021, Bitcoin is up around 57%. Over that same time, the S&P 500 is also up around 57%.

Still, Bitcoin’s recent surge has a lot of people wondering if they need to buy some. I’ve had more questions about Bitcoin over the past two weeks than I have in the past two years. Which is great—I love getting questions and having a discussion.

But I can’t help but think to myself:

“Wouldn’t the best time to get into an investment be before it went up 480% in two years?”

Where were all of these people clamoring to buy Bitcoin in 2022 when it was at $17,000? Unless I’m mistaken, I think you want to buy an investment before it has insane returns in a short period of time, not after.

Ok, but what about Bitcoin’s long-term wealth-generating prospects?

This is a tough question to answer.

Do I personally think that crypto is going to overturn the traditional financial system, become a worldwide currency, and change our way of life forever?

Consider me very skeptical on that front.

Although, I do think it’s clear that Bitcoin is here to stay. It’s penetrated our culture and enough people believe and are invested in it that my guess is it will continue to exist.

However, the issue with trying to figure out Bitcoin’s value is there still is no real use case for it. It doesn’t do anything. There is no underlying business that provides goods or services. There are no cash flows. There is no CEO or board that governs it. The price fluctuates seemingly on the whims of techies who decide it’s worth more today than yesterday because Elon Musk is going to be a part of Trump’s administration somehow and he’s crypto-friendly.

As of now, it’s an asset that can provide incredible gains really quickly, but you can also experience debilitating losses just as quickly.

In that sense, I would treat Bitcoin like any other highly volatile, speculative asset. If you want to add some Bitcoin to your investment portfolio, create some rules around it. Allocate a small portion of your overall portfolio so you don’t jeopardize your financial future by having your entire portfolio tied up in any single investment. Especially one as volatile as Bitcoin.

If Bitcoin happens to boom again, a little is all you’ll need. If it doesn’t, a little is all you’ll want.

The last thing I’d like to point out is the majority of people jumping headfirst into Bitcoin are not doing so with a lot of money. As of a few years ago, about 82% of Bitcoin accounts were under $100, and 94% of accounts were under $1,000.

So try not to feel too much FOMO when your friend puts $500 into Bitcoin. Even if the best-case scenario is they double or triple their money, they may have bragging rights, but it’s not making any meaningful impact on their financial life.

If they are investing with life-changing money, they’re also taking on life-changing risks. If they win they might be able to retire tomorrow; however, if they lose they could delay their retirement by 10-20 years.

Warren Buffet once wrote:

“Investing is not a game where the guy with the 160 IQ beats the guy with the 130 IQ. Once you have ordinary intelligence, what you need is the temperament to control the urges that get other people into trouble in investing.”

Thanks for reading!

Jake Elm, CFP® is a financial advisor at Dentist Advisors. Jake a graduate of Utah Valley University’s nationally ranked Personal Financial Planning program. As a financial advisor at Dentist Advisors, he provides dentists with fiduciary guidance related to investments, debt, savings, taxes, and insurance. Learn more about Jake.</em