In a recent conversation I had about preparing for the future, I was asked if it’s possible to be saving too much money. Now, I realize this a privileged question given that the majority of people are definitely not saving enough. Wondering if you’re saving too much is a great problem to have and definitely preferable to the alternative. But I do think it’s something to consider.

My initial response to this question is yes, I do think it’s possible to save too much money. Every dollar you make will eventually be spent. You can either spend it now, spend it later, or pass it on to someone else to spend. Saving is just deferring spending to the future. And prioritizing future spending to the complete detriment of current spending doesn’t make a lot of sense to me.

So, you may be saving too much if your savings rate is keeping you from enjoying life now with the hope that someday you’ll be able to enjoy it.

The following comic perfectly describes this point:

This is not an endorsement to become reckless with your money. There needs to be a balance between saving responsibly for the future while still enjoying life today. Striking that balance is difficult because no one knows what the future will bring.

Yet, while a lot of financial media is prone to feed on people’s fears by scaring them to save more and cut out all unnecessary spending, the data suggests that those who are consistent savers tend to overestimate how much they’ll need to retire.

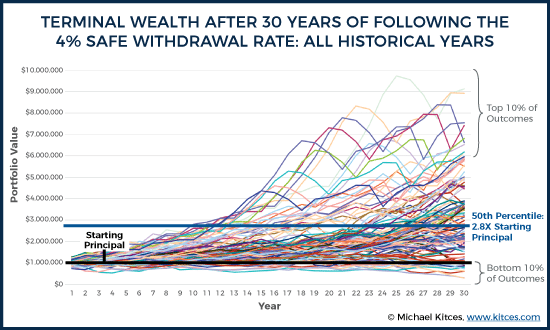

Michael Kitces conducted a study to determine how often retirees actually run out of money during retirement. Using historical market returns and a 4% withdrawal rate (spending 4% of your principal each year), he mapped out the potential outcomes over a 30 year time period:

On average, a 4% withdrawal rate results in the retiree finishing with more than triple the original amount they retired with. In only 10% of the scenarios does the retiree finish with less than the amount they started with. You’re just as likely to 6x your money as you are to finish with less than 100% of your starting amount.

Simply put, more wealth has been created in retirement than destroyed.

All of this is not meant to discourage saving and preparing for the future, but rather to encourage more balance. Many people are so stressed about saving for the future that they forget to enjoy life today.

That mindset is hard to turn off. People think that if they could just reach a certain number, their behavior and anxiety around money will magically change. However, that’s usually not the case. It’s hard to undo decades of financial habits. There are plenty of people who are comfortably retired and still can’t bring themselves to order dessert.

Try to enjoy some of your money now. Find the balance that works for you. If you have a hard time spending on yourself, then enjoy it with friends and family. What’s the point of saving money if you never plan on spending some of it?

As Nick Maggiulli says, you probably won’t spend all of your money, but you will spend all of your time. So, if you’re a diligent saver, try not to spend your life worrying about money only to let someone else enjoy it.

Thanks for reading!