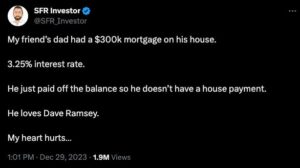

I don’t have a Twitter (or X) account anymore, but there was a tweet from a few days ago that got enough traction that my non-Twitter-using self came in contact with it through a podcast I listen to. Here’s the tweet from SFR Investor:

(FYI: SFR stands for Single-Family Rental)

What’s interesting about this post is the majority of the comments are people disagreeing with SFR Investor and praising the friend’s dad for paying off his loan.

“You can’t put a price on peace of mind!”

“Whatever helps you sleep at night!”

“Don’t have to be tied down to debt ever again!”

Now, I’m a big advocate for the idea that no universal answers exist when it comes to personal finance. Rarely are things ever black and white—just different shades of gray that work for people’s unique situations and personalities.

But!

I do think there can be times when behavioral finance can be taken too far. You can’t always make financial decisions solely based on emotions and how you feel. Sometimes the spreadsheets and the numbers do matter.

“You can’t put a price on peace of mind.” Well, sometimes I think you can. Let’s see if we can’t figure out the actual cost of peace of mind in this instance.

I’m going to have to infer some of the details of the loan here. With a 3.25% interest rate, this person must have either bought or refinanced the house a couple of years ago when rates were that low. So, let’s assume a 30-year loan with five years of payments already made to keep the numbers easy.

Here are the details:

• Mortgage Balance: $300,000

• Term: 25 years

• Interest Rate: 3.25%

• Monthly Payment: $1,305

With those loan terms, the remaining amount of payments over the life of the loan would be $391,691, including a total interest cost of $123,770. That big interest outlay over the course of a 30-year loan is what terrifies people and is one of the main reasons cited for wanting to pay off a loan early.

So by paying off this loan in one fell swoop, this man saved himself $123,770 in interest and freed up $1,305 each month.

Not bad at all.

But while compound interest can work against you, it can also work for you.

Let’s say instead of using $300,000 to pay off his mortgage, this guy invested that money in the stock market. The average long-term return for the U.S. stock market has historically been 10% per year. If he invested $300,000 at a 10% annual return he’d end up with $3,250,411 after 25 years.

Let me write that again.

$123,770 versus $3,250,411.

Now, some of you may be saying, “Well, after I pay off my mortgage I’m going to take the payment and invest all of it now that I don’t have that monthly expense.”

In my experience, that idea sounds good in theory but I rarely see it actually happen. Some other expense will rise to take its place; whether it’s moving to a newer, now-more-expensive house, or it’s finally time to update the home with a serious remodel, or even just one or two more vacations each year now that you don’t have to worry about a mortgage payment.

Regardless, for the sake of the exercise, let’s assume he paid off his mortgage and then invested the $1,305 every month for 25 years. At the same rate of return, he’d end up with around $1,540,114. Less than half of what he could have earned.

So this peace-of-mind decision could cost this person millions of dollars in the long run.

I have yet to mention that mortgage interest is tax deductible so your actual interest costs each year are lower after you factor in taxes. And at this very moment, there are money market funds or high-yield savings accounts that will pay you a 5% return for holding cash. That money in a high-yield savings account would pay for his interest costs on the loan. And then some.

On top of that, how about the peace of mind that comes from having liquidity? You can’t get that money back. By making a large, extra-debt payment you give up the flexibility, safety, and ability to change your mind that comes with having liquid money available to you when you need it.

While financial decisions will differ depending on everyone’s unique circumstances, there are certain financial decisions that are far more black and white than others.

Thanks for reading!