This summer my wife and I are planning on taking the plunge into the home-buying process and hopefully, we’ll come out on the other side with a house. Buying a house is a complicated, emotional decision that usually ends up being more of a lifestyle decision rather than a financial one.

At the same time, a house is generally the biggest purchase most people make and will significantly impact their financial situations. With the housing market going crazy this past year, it’s easy to be intimidated by the skyrocketing prices.

As we’ve told people that we’re looking to buy, the most common response has been, “In this market?? Good luck!” followed by a story about someone they know who recently had to pay an arm and a leg above the asking price.

I’ve written about figuring out how much house you can afford in a previous post, but today I’d like to focus on the housing market in general and if it’s a good time to buy or not.

It’s true, the U.S. housing market is on fire right now. Certain areas are hotter than others, but pretty much nationwide we’re seeing house prices increasing rather rapidly. Demand is really high and supply is low.

Currently, there are more real estate agents than homes for sale in the U.S.! Homes for sale are down 26% from last year while more people are looking to buy.

This housing boom can be attributed to a number of things. If I had to guess, I would say a large part is due to the work-from-home movement. People are moving from expensive cities to more affordable areas, many are realizing they’re going to be spending a lot more time at home and may need to upgrade, and stimulus checks have put extra money in people’s pockets.

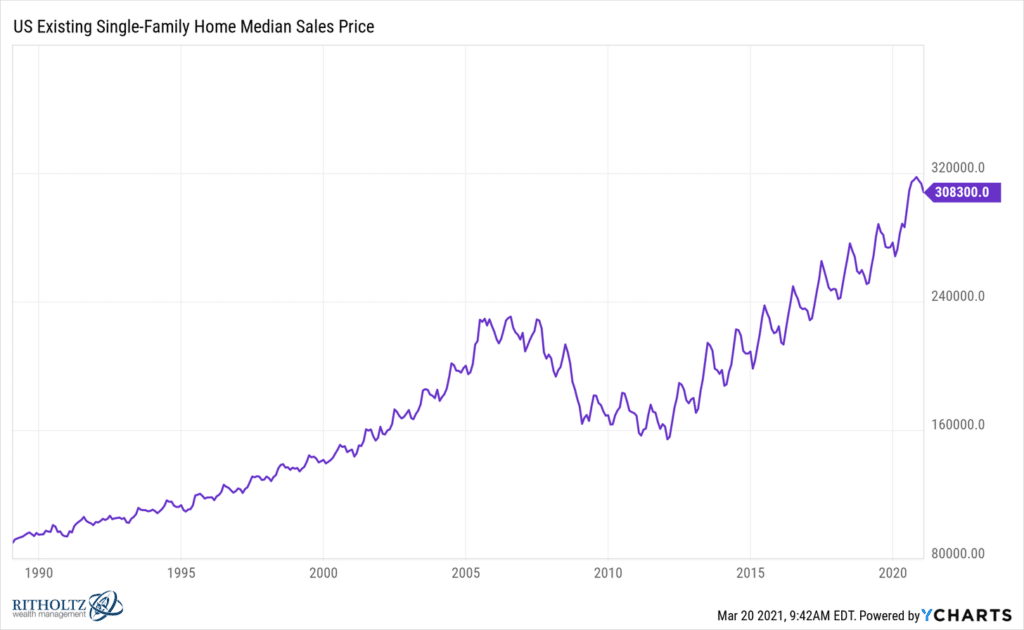

Below is the median sales price for single-family homes since 1989:

Prices are up 240% since 1989 and 56% since 2013 alone. Yet, the housing market may not be as expensive as you might think.

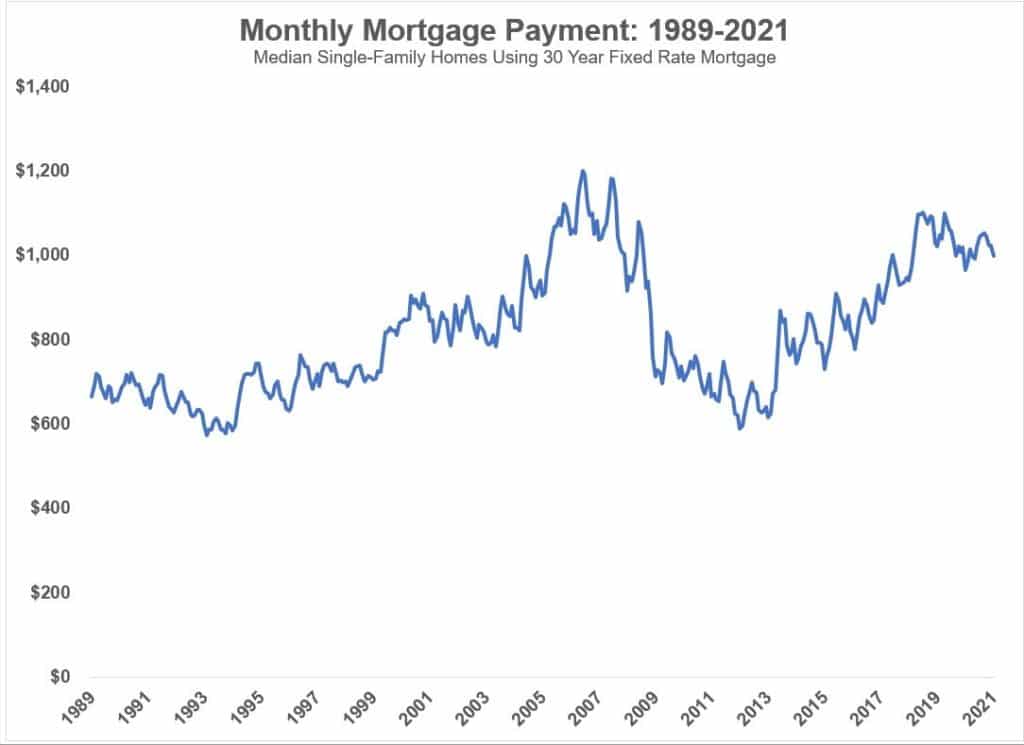

Sure, prices are far higher than they were in the past, but borrowing rates are far lower. Mortgage rates were over 10% in 1989 and today’s rates are only around 3%. So, while house prices have shot up, monthly mortgage payments have stayed reasonable.

Shoutout to Ben Carlson for putting together the following graphs. The graph below shows median monthly mortgage payments using a fixed 30-year rate:

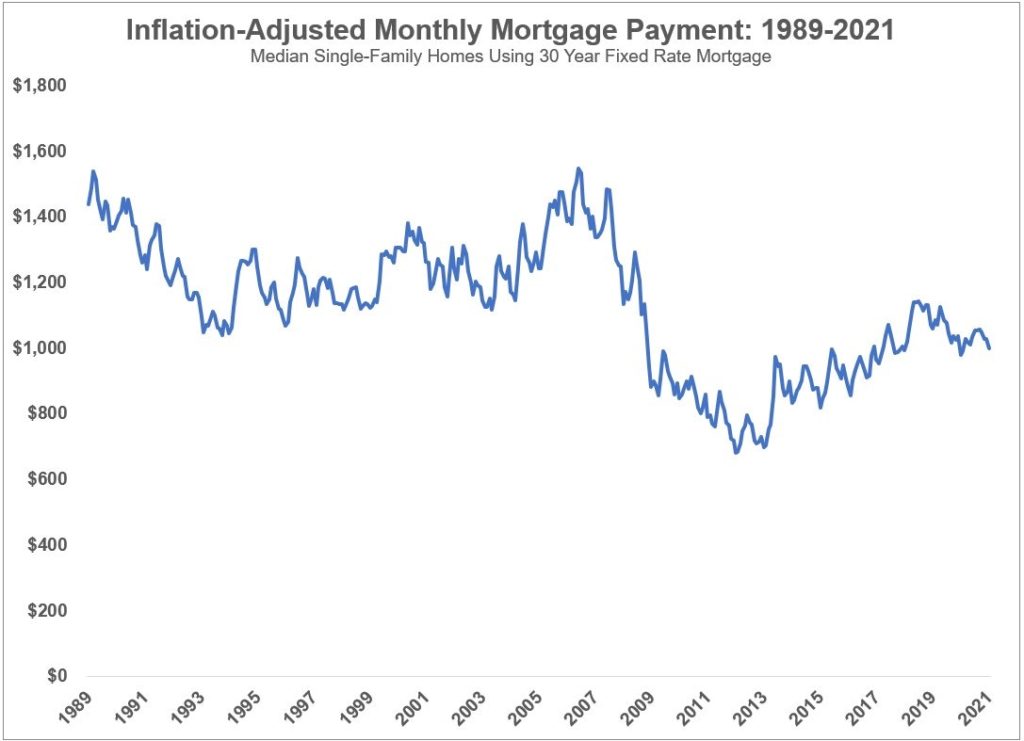

In real terms, today’s monthly payments are higher than what they were in 1989, but below what people were paying in 2006 and 2007. If you adjust for inflation, you get this:

After adjusting for inflation, monthly mortgage payments are actually 30% lower than what they were in 1989.

Now, this is not to say that it’s not hard to buy a house right now. Multiple bids over asking, all-cash offers, and the inability for a large segment of the population to come up with a sufficient down payment as prices continue to rise makes getting a house difficult.

But is it a bad time to buy?

I don’t know. As I wrote about last week, it’s nearly impossible to identify financial bubbles in the moment. The housing market could slow down, or it could continue on its current trend.

What I do know is that now is the right time for my wife and me personally. We talked over our situation and we feel like it’s the right decision for us. That means our decision was made regardless of what’s happening with something uncontrollable and unpredictable like the economy or housing market.

Again, it’s more of a lifestyle decision than a financial one. But aren’t all financial decisions lifestyle decisions as well? What’s the point of making a smart financial move if it doesn’t directly benefit your life?

Thanks for reading!