As part of my job, I sit down with the individuals I work with at the beginning of each year to review their household budgets. We want to know how much money is coming in and where it’s going.

Going through numerous budgets over the past few weeks, one constant that emerged across each unique situation was an increase in personal spending compared to previous years.

And when I say it was consistent I mean in literally every single budget, 100% of the cases, spending went up.

At first, I thought this was strange. But after thinking about it some more I realized increased spending is the norm. It is extremely rare to see someone’s expenditures go down over time. Is it possible to decrease spending? Of course. But I think it’s the exception rather than the rule. Once you’re comfortable living a certain lifestyle, it’s very difficult to cut back.

It’s fascinating to look back and see how spending can creep upward almost imperceptibly as we move through life.

Now, I know what you’re thinking, “It’s all due to inflation. Our spending goes up because things cost way more today than they did in the past.”

I’m not sure that quite gets to the truth of it.

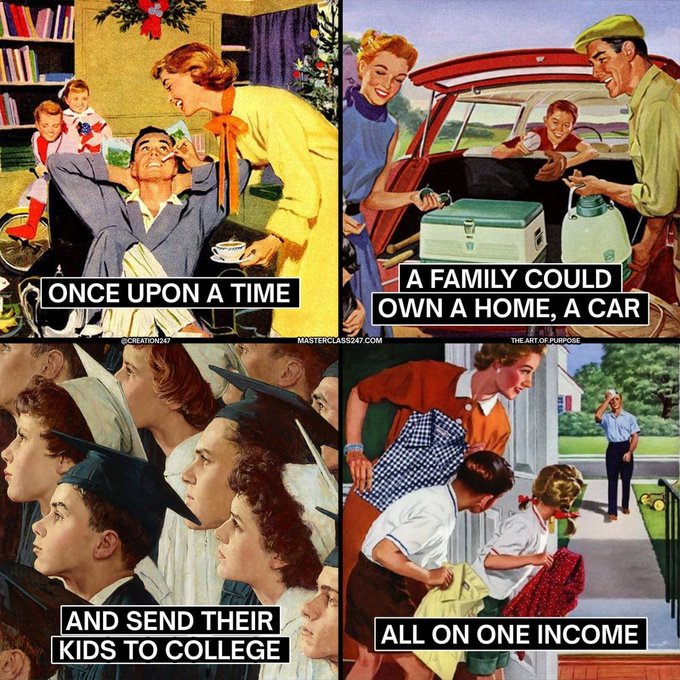

You’ll see stuff like this scattered throughout social media:

The caption to this post was “What went wrong?”

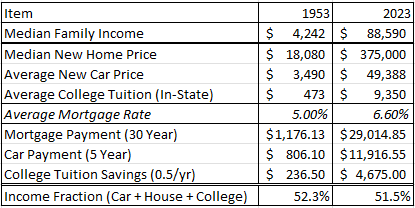

Well, nothing really. While the cost of a home, a car, and college tuition has certainly gone up in recent decades, our wages have more than kept pace to account for these price increases.

Adjusting for wage growth, buying an average house, a new car, and sending two kids to college is more affordable today than it was in 1953.

How about this one?

In 1980, food consumed 15% of an average household’s budget. In 1950 food was 29% of the average budget. Today food only takes up about 9% of a family’s income.

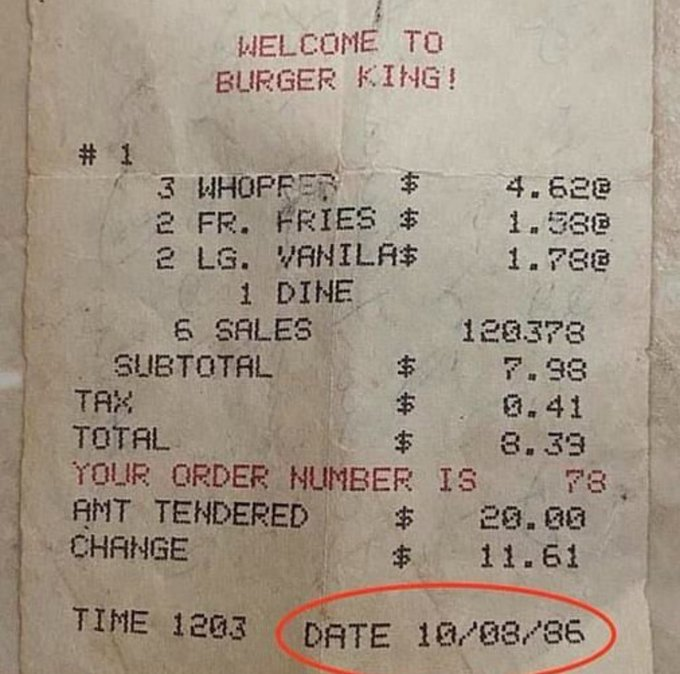

Here’s one more:

The average hourly wage in 1986 was $7.87, meaning it took slightly more than one hour of labor to buy that Burger King meal.

The average hourly wage today is $29.66, and you can buy that same meal at your local Burger King for $27.19, less than one hour of labor.

Adjusting for inflation, the median family income was $29,000 in 1955. In 1965 it was $42,000. In 2021 it was $70,784.

There’s really no evidence to show that life is any more expensive now than it was in the past.

In going through different budgets, including my own, increased spending wasn’t solely due to groceries being more expensive. In most cases, the fixed, necessary expenses (housing, transportation, groceries, childcare) stayed relatively level while the majority of the increase was simply due to lifestyle purchases (a.k.a buying more stuff).

Compared to past generations, we’re actually spending less of our income on necessary expenses and more on everything else.

Believe it or not, a family still can afford to buy a house, buy a car, and send their kids to college on an average income today. But why our budgets may feel more strained than ever is we want all of those basic necessities AND:

- to eat out multiple times a week

- to go on multiple family vacations a year

- to have the newest iPhone, laptop, and headphones

- to buy every version and color of a Stanley Cup

- to maintain all the latest skincare and beauty products

- to have a walk-in closet, six burner stove, room for a home office, and home gym

I could go on and on.

These are things that people 30+ years ago would consider luxuries that we now consider commonplace, or even “necessary.”

It isn’t so much that life is more expensive today, it’s that our definition of what average life should look like has risen drastically. While average incomes have kept pace with inflation, they’ve been left in the dust by our expectations.

From a recent blog post by Morgan Housel:

“Kevin Kelly once made the point that if you want to know what lower-income groups will aspire to spend their money on in the future, look at what higher-income groups do today. European vacations were once the exclusive playground of the rich. Then they trickled down. Same with college, investing in the stock market, two-car households, lawns, walk-in closets, and six-burner stoves – what was once a luxury of the rich became standards of the masses.”

Morgan also writes about this in his latest book, Same As Ever:

“Today’s economy is good at generating three things: wealth, the ability to show off wealth, and great envy for other people’s wealth.

It’s become so much easier in recent decades to look around and say, ‘I may have more than I used to. But relative to that person over there, I don’t feel like I’m doing that great.’

We have higher incomes, more wealth, and bigger homes—but it’s all so quickly smothered by inflated expectations.”

Now to be clear, I’m not advocating to never spend any money and to eat Top Ramen for every meal. As you make more money, your lifestyle should improve. What’s the point of working hard to earn more if you can’t enjoy some of it?

But there’s a limit to how much you can let your spending drift before it starts affecting your financial future. The reason more spending can be so damaging is that every increase in spending negatively affects your finances twofold:

- it decreases the amount of money you have left over to save each month

- it increases the amount of money you’ll need to replace when you slow down or stop working

This concept also works in reverse. The more you save the less you’ll spend, and the less you spend the smaller nest egg you’ll need to live off of in retirement. Controlling spending is essential to creating wealth.

Finding a happy balance between spending and savings is hard. I don’t think I know anyone who has it perfectly mastered. But I do like this mental framework from Ben Carlson:

“The way I look at it is my savings rate should be just high enough that it feels a little painful at times.

Can you imagine the stuff we could buy if we weren’t saving so much money?!

But I should also be spending enough money that it feels a little painful at times.

Can you imagine how much that money would be worth in 20-30 years if we didn’t spend it?!”

There are no hard and fast rules for how much you should be saving and spending. Every situation is different. However, if you’re looking for a rule of thumb, if you can save 20% to 30% of your income I wouldn’t be worried too much about how much you spend after that.

Learning how to live with less is a powerful financial lever because you have more control over it than things like income or investment returns. The person who makes less but needs less is more wealthy than the person who makes a lot but needs more.

Thanks for reading!

This article was originally featured on “Money Talks” Substack.

Jake Elm, CFP® is a financial advisor at Dentist Advisors. Jake a graduate of Utah Valley University’s nationally ranked Personal Financial Planning program. As a financial advisor at Dentist Advisors, he provides dentists with fiduciary guidance related to investments, debt, savings, taxes, and insurance. Learn more about Jake.