Here are some charts and financial data that caught my eye this week:

The 2010s were an incredible decade for U.S. stock performance. In fact, we’re coming out of the longest and best stretch of U.S. outperformance compared to foreign stocks in over 50 years.

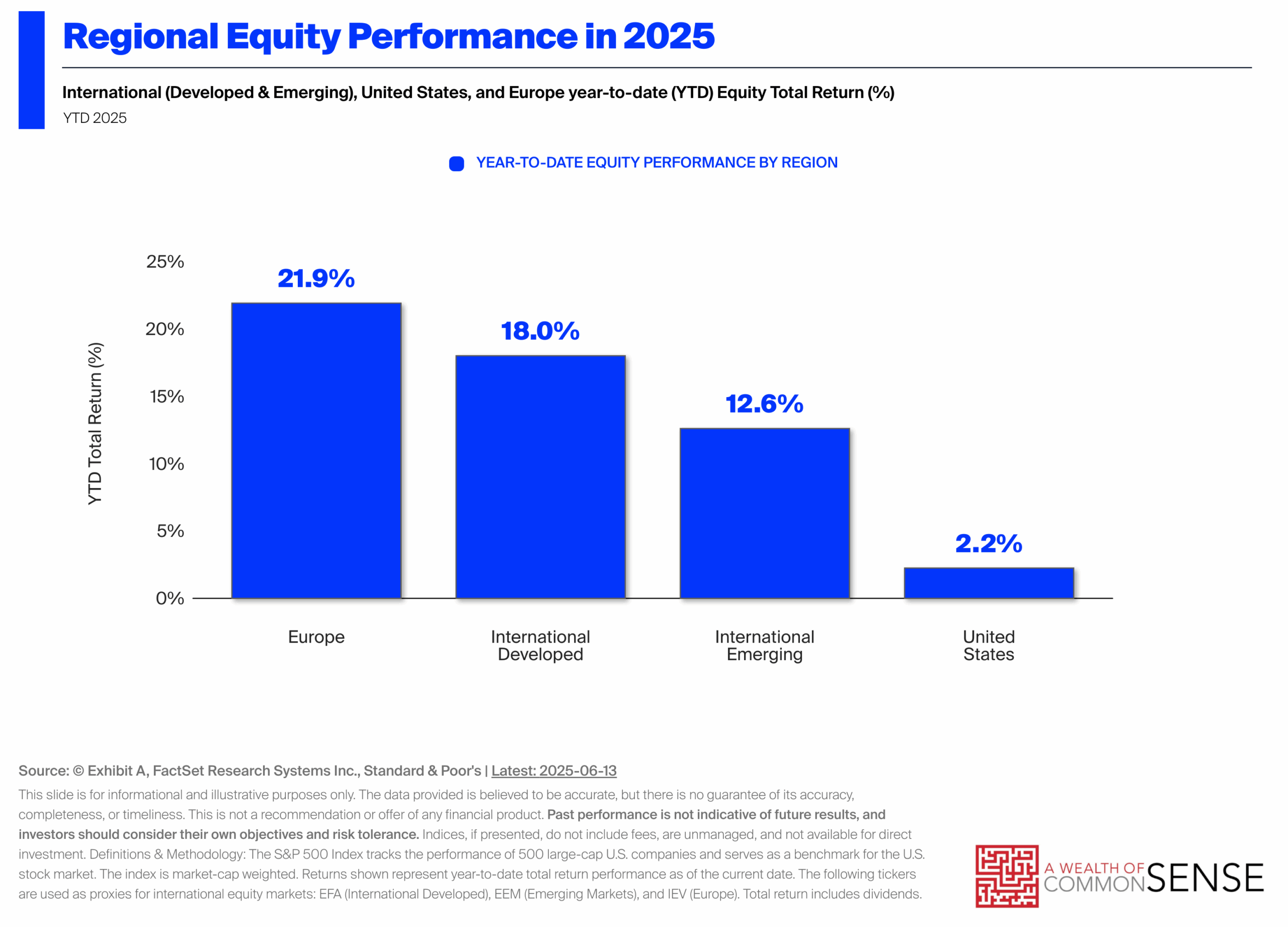

However, international stocks are making a comeback this year. The following graph shows the year-to-date performance of each sector up until the middle of June:

As you can see, stocks from other countries are finally outperforming. And not by a small margin.

If you go back further than January, you’ll find that foreign stocks have actually been outperforming U.S. stocks for a few years now. Jeffrey Kleintop shared a chart that shows European stocks versus U.S. stocks going back to the bottom of the 2022 bear market:

Europe has outperformed the U.S. by 30 percentage points.

Will this trend continue? We’ll see.

One of the few dependable features of investing in the stock market is that it’s cyclical. There is no one strategy or segment of the market that works all of the time.

If it seems like U.S. stocks always outperform other countries, that’s recency bias at work. Just because the S&P 500 has done incredibly well over the past decade does not mean that it will continue to do so forever into the future.

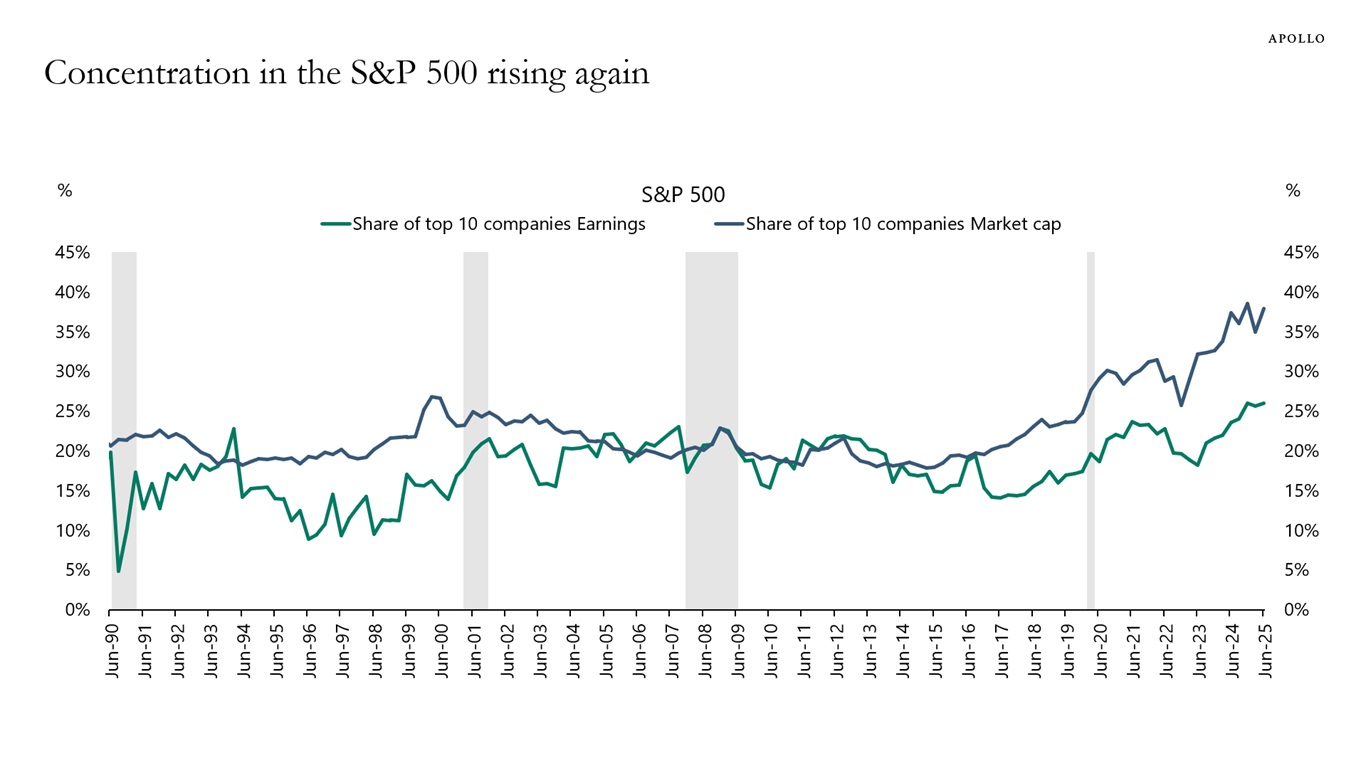

Speaking of the S&P 500, the index is becoming increasingly concentrated, with the top 10 companies accounting for 40% of the overall index:

If you’re seeking to diversify your investments, the S&P 500 may not be the best place to invest your money. Right now, it’s essentially a bet on the Magnificent 7 stocks growing even bigger.

I have heard some people say that investing has been “easy” recently, all you have to do is buy the Mag 7 (Nvidia, Microsoft, Apple, Amazon, Google, Meta, and Tesla) and hold.

While it’s true these big, popular tech stocks have had great returns in recent years, the experience of holding these stocks hasn’t exactly been easy. The following chart shows the max drawdowns for each of these stocks in 2022 and so far in 2025:

Holding individual stocks can be a volatile ride.

And before you think that all you need to do is ride out the crushing downswings, and eventually these stocks will get back to all-time highs, keep in mind that more than 40% of all U.S. stocks over the past 40 years had a decline of at least 70% and never recovered.

Picking individual stocks is a difficult game to play.

I want to switch gears for my final chart and talk briefly about cars. Today, 70% of U.S. households own two or more vehicles:

Here are some car-related stats from the Wall Street Journal:

- The total cost to own a car in 2024 averaged $12,296, which is 30% higher than a decade ago.

- New cars cost an average of $48,883, with an average loan payment of $745.

- Used cars cost an average of $25,500, with an average loan payment of $521.

- The average repair cost was $838 in 2024

For most of us, owning a car is a necessary expense. But I want to point out that it is an expense, not an investment. Cars do not hold their value.

And since the cost of transportation is typically the second biggest fixed cost in people’s budgets behind housing, how much you choose to spend on a car will have a big impact on your ability to save and invest for retirement.

So be careful out there. Cars have a tendency to wreck people’s budgets.

Thanks for reading!

Jake Elm, CFP® is a financial advisor at Dentist Advisors. Jake a graduate of Utah Valley University’s nationally ranked Personal Financial Planning program. As a financial advisor at Dentist Advisors, he provides dentists with fiduciary guidance related to investments, debt, savings, taxes, and insurance. Learn more about Jake.