The U.S. stock market is up around 14% since January. Not bad for a six-month stretch and a welcome sight since last year left little to celebrate in the way of market gains.

What’s interesting about this market rally is almost all of the S&P 500’s gains are from the surging prices of just a handful of the largest companies.

The stocks responsible for the overwhelming majority of the market gains in 2023 are:

Nvidia: 183%

Tesla: 135%

Meta: 125%

Apple: 51%

Amazon: 48%

Microsoft: 39%

Alphabet: 33%

If you removed these seven stocks from the S&P 500, the combined return of the other 493 companies has been negative so far this year.

And all of these seven high-performers are also currently in the top 10 biggest stocks in the U.S., the other three missing from the list are Berkshire Hathaway, United Health, and Exxon.

So, with the recent great performance of these big, popular tech companies and the relatively poor performance of the vast majority of other U.S. stocks, the question that begs to be asked is:

Should you only buy the biggest stocks? Are the biggest stocks also the best-performing stocks?

As with many stock market questions, we can look at the past to give us an idea of how markets work and what to expect going forward.

Let’s start by taking a look at the biggest stocks from 20 years ago and how they’ve performed since. The eight biggest companies in 2003 were:

1. General Electric: -0.08% annual return

2. Microsoft: 16.2% annual return

3. Pfizer: 4.5% annual return

4. ExxonMobil: 8.7% annual return

5. Walmart: 7.5% annual return

6. Citigroup: -8.7% annual return

7. Intel: 5.1% annual return

8. IBM: 5.2% annual return

Now if we compare these returns to an S&P 500 index fund which provided a 9.8% annual return since 2003, only one of the eight companies outperformed the index itself.

I also think it’s worth noting that only one of the top 10 biggest companies in 2003 remains in the top 10 today.

Now if we compare these returns to an S&P 500 index fund which provided a 9.8% annual return since 2003, only one of the eight companies outperformed the index itself.

I also think it’s worth noting that only one of the top 10 biggest companies in 2003 remains in the top 10 today.

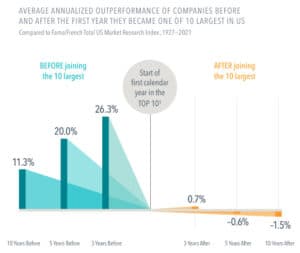

Dimensional has an awesome chart that looks at the annualized outperformance of companies before and after they make it into the top 10 biggest stocks:

As you can see, size is often the enemy of outperformance. History tells us that once you become one of the biggest stocks, the odds of meaningfully outperforming the market are very small.

Another thing this graph shows is what you want to do is own small stocks that will eventually make it into the top 10.

This sounds good in theory, but unfortunately, it’s an extremely hard game to play.

Hendrik Bessimbinder’s work found that just 86 companies accounted for half of all the gains in the stock market since 1926. And all of the wealth creation in the stock market since then can be attributed to around one thousand of the top-performing stocks, which is just 4% of all the stocks in the market.

Good luck trying to consistently find the 4%.

The cool thing about investing is there are many ways to go about it. You don’t have to try and pick the biggest winners. You can instead buy a diversified basket of stocks and let the indexes pick the winners for you.

Thanks for reading!