I’ve seen quite a bit of chatter on my Twitter timeline this past week or so about the yield curve. Since the yield curve isn’t something that comes up in ordinary conversation, at least not in my conversations, I figured I’d write about it. I realize this isn’t a naturally exciting topic for most normal people and is more into investment weeds than I typically like to go with these posts, but I think it’s interesting and maybe some of you will too.

If you stick with me, I do have an overarching investment point that I want to make by the end.

A yield curve is a line on a graph that plots yields (interest rates) of bonds which have equal credit quality but different maturation (ending) dates. The yield curve, the one that market prognosticators pay attention to, measures the short and long-term rates of U.S Treasury bonds and their relation to each other. The reason the yield curve matters is it’s often used to gauge the health of the economy.

The yield curve can be classified as normal, flat, or inverted. A normal yield curve is when long-term U.S. bonds offer higher returns than short-term U.S. bonds and an inverted curve is when the opposite is true.

An upward sloping or normal yield curve indicates healthy economic prospects — most likely higher growth and inflation in the future. A negatively sloped or inverted yield curve indicates poor economic prospects — most likely lower growth and current inflation.

If the above paragraphs don’t make any sense, all you need to know is that generally, a positive yield curve is a good sign and an inverted yield curve is a bad sign.

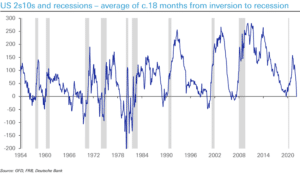

Last week the yield curve inverted for the first time since 2019, which makes investors nervous. Why? Because, historically, yield curve inversions have been a pretty reliable indicator of a coming recession. The following chart shows the yield curve (in blue) along with when the U.S. was in a recession (in gray):

As you can see, nearly every time the yield curve has inverted (the blue line has gone below zero), a recession has followed within the next few years.

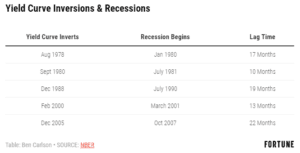

Since 1978, there have been six yield curve inversions not including last week. Here’s a graph that shows the date of five of these inversions and when the U.S. went into a recession afterward:

A yield curve inversion seems to be one of the few indicators that actually “works” at predicting an upcoming recession.

Given this information, what’s an investor to do?

Well, I’d start by saying that just because an inverted yield curve has predicted recessions in the past does not mean it will always continue to do so. The signal doesn’t work on a set schedule. It’s possible that the simple fact investors are now more aware of this signal could alter its usefulness going forward.

But let’s say you have 100% faith in the yield curve as an economic indicator and are convinced a recession is imminent. Should you get out of stocks and move to cash? I don’t think that’s a great move considering inflation is at 7%. Should you move to bonds? Data shows that bonds still underperform stocks following a yield curve inversion.

So, what should you do then?

Nothing. Stay the course. Stick to your investment strategy.

Even if the yield curve does predict a recession yet again, what you can’t predict is:

• When the recession will happen.

• If/when the stock market will begin to fall.

• The magnitude or length of the recession and stock market correction.

• No one can time the stock market.

While it’s true that the inversion of the yield curve usually means that U.S. stocks will underperform and we will experience a recession within the next 12 months to 24 months, the yield curve last inverted in August 2019, and U.S. stocks are up 68% since then. If you had moved to cash or another investment at that time you would have missed out on all of those gains.

The only real course of action is inaction. Go on with your life and let the markets do what they’re going to do. I know that can be an unsatisfying answer for some. Jeremy Siegel has said:

“Fear has a greater grasp on human action than does the impressive weight of historical evidence.”

But it’s often the right answer. The long-term trajectory of the stock market isn’t inhibited by inverted yield curves or any other short-term indicator.

One tip to help you stomach the ups and downs of the stock market and stay invested would be to only invest money that you won’t need in the near future. It’s easier to ignore daily market movements when your only focus is on what your account value will be in years from now.

Most of the time the most optimal thing you can do for your portfolio is nothing.

Thanks for reading!