I wanted to share a few things I’ve recently come across that have caught my attention and caused me to think.

#1

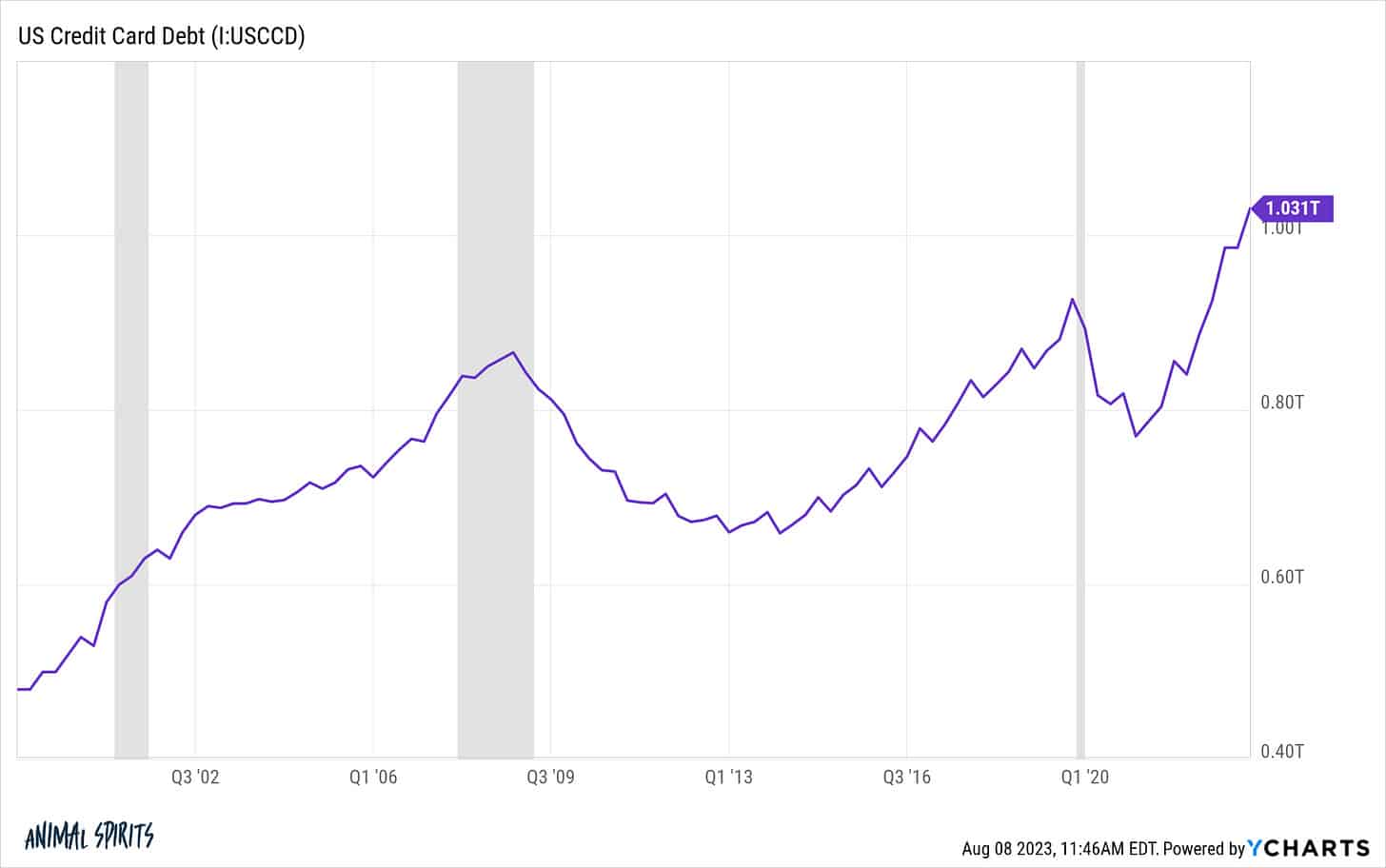

For the first time in U.S. history, outstanding credit card debt has surpassed $1 trillion, according to Yahoo Finance.

As you can see, overall debt has surged since the beginning of 2021 as people have spent down their excess savings built up from the pandemic.

A trillion dollars is such a large, scary number that some people have proclaimed this news to be a troubling sign for the future of the U.S. economy.

And those people may be right. With the average interest rates on credit cards above 20%, carrying a balance from month to month can be extremely damaging to your finances. “Always pay off your credit cards each month” is excellent financial advice that applies to everyone.

However, Ben Carlson wrote an article where he argues that while credit card debt is harmful to individual households, it doesn’t have to mean the downfall of the U.S. economy.

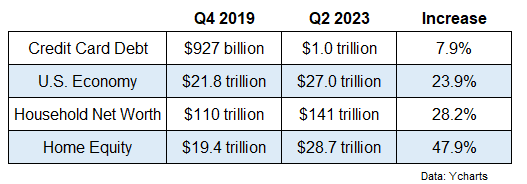

That big debt number needs to be put into context. Mainly, the increase in credit card debt doesn’t look nearly as bad when compared with the massive growth in the economy, individual net worth, and home equity.

Now, you could point out that the people struggling the most with credit card debt aren’t benefiting from the rise of asset prices. Which is fair. But the data shows net worth for the bottom 50% of households has still increased 70% since 2019. Also, the bottom 50% has also seen the highest wage growth during this timeframe.

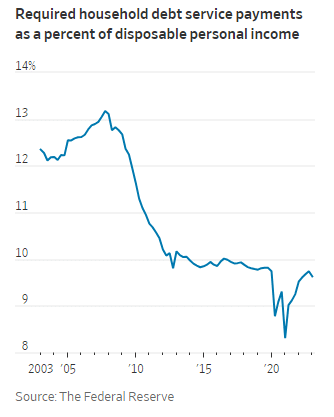

So even with this rise in credit card debt, household debt payments as a percentage of income is nowhere near where it was during the last financial crisis:

Something to think about.

#2

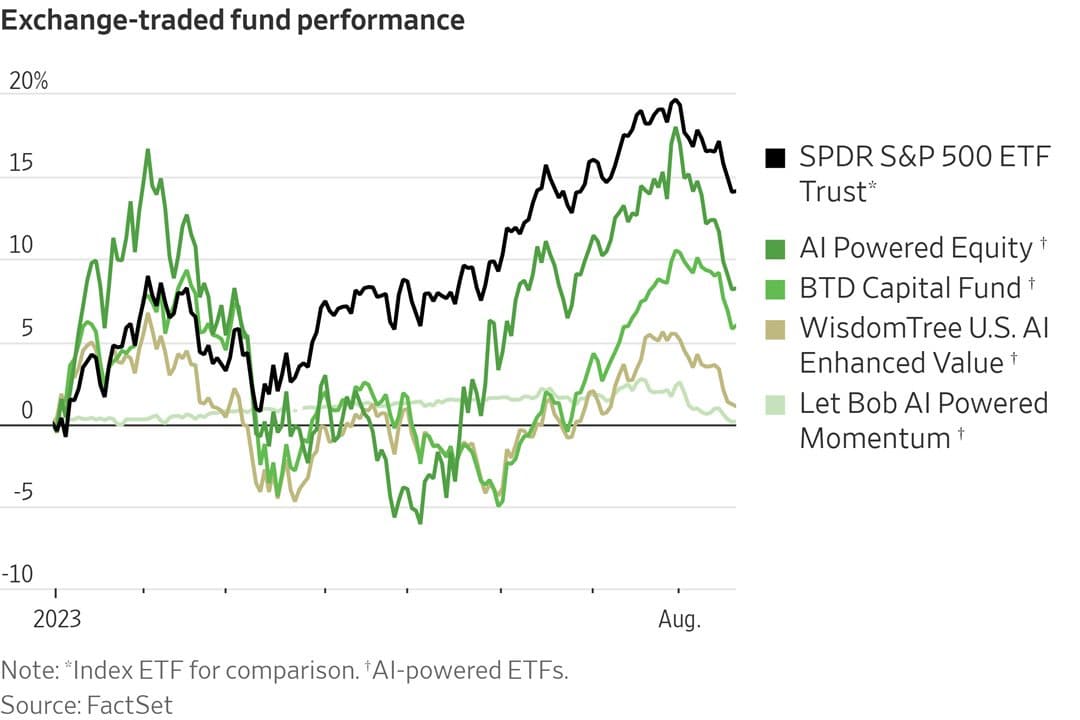

Despite the enthusiasm around artificial intelligence, FactSet reports that investment funds that put A.I. applications in charge of managing their portfolios are significantly underperforming the U.S. market:

Of course this is a very small sample size so take it with a grain of salt, but I find it interesting that these A.I. models likely have access to an entire history of trading strategies, market trends, current news headlines, any market information you could want, and they still can’t beat the market. What does that say about the average investors’ odds of outperforming the market over time?

#3

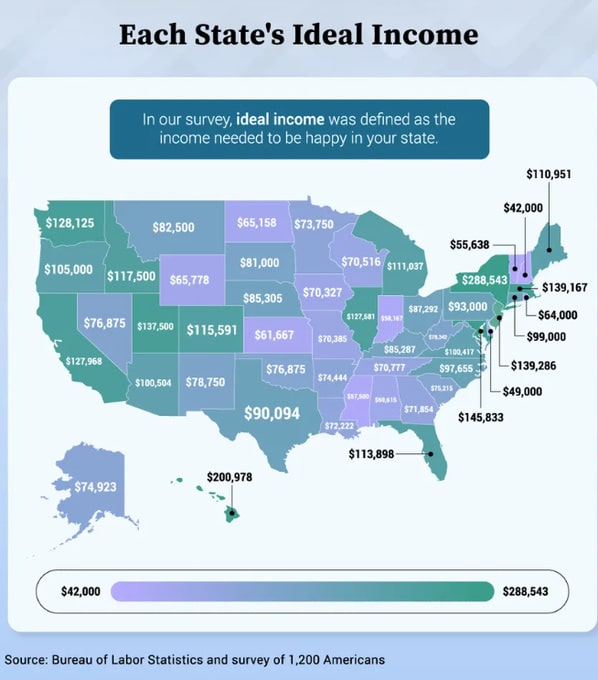

The Bureau of Labor Statistics conducted a survey asking workers what annual income they feel they need to earn to “be happy.” Here are the results broken down by state:

#4

The following quote is from an article Nick Maggiulli wrote titled “If You’re So Rich, Why Are You Desperate?”

“I’ve seen plenty of examples of people bragging about how wealthy/successful they are while still chasing after more. And whenever I see this, I think the same thing: If you’re so rich, why are you desperate?

After all, if you’re so good at building wealth, why don’t you just go and build more for yourself instead of selling me on how to build it?

I don’t think these individuals are actually desperate for more money. No, they are desperate for more attention, status, and respect. After all, money by itself can’t provide you with a deeper sense of purpose.

In the case of Felix Dennis, [he] chased riches for the act of chasing riches in itself. As he stated:

…making money is a drug. Not the money itself. The making of the money.

A similar sentiment can be found in The Money Game by Adam Smith:

The irony is that this is a money game and money is the way we keep score. But the real object of the Game is not money, it is the playing of the Game itself. For the true players, you could take all the trophies away and substitute plastic beads or whale’s teeth; as long as there is a way to keep score, they will play.”

#5

Multiple studies have actually managed to put a dollar value on how much the social aspects of our life are worth. This data comes from Rob Henderson’s newsletter, The Happiness Lottery.

In terms of the effect on happiness:

• Having a friend you see regularly is worth $100,000 a year

• Being married is also worth $100,000

• Seeing your neighbor regularly is worth $60,000

• Being in good physical health is worth $400,000

“Other research suggests that income doesn’t have a lasting increase on happiness because people usually adapt to money. In contrast, marriage, family, and health have lasting increases on happiness and are immune to hedonic adaptation.

Compared with not attending any religious service, attending a religious service once a week has the same effect on happiness as moving from the bottom to the top quartile of the income distribution.

A poor person with a spouse, a close friend, a relationship with a neighbor, and who attends a religious service can achieve the same level of happiness as an affluent upper middle class person.

The fortunate among us can share our wealth, sure. But we might also share our values—steps we have taken to live fulfilling lives.”

Thanks for reading!