In a wonderful article recently published by Morgan Housel, he proposes that the more trivial our disagreements and arguments as a society, the better off society actually is.

“Part of the reason today’s world is so petty and angry is because life is currently pretty good for a lot of people.

There are no domestic wars.

Unemployment is low.

Household wealth is at an all-time high.

Innovation is astounding.

As the world improves, our threshold for complaining drops. In the absence of big problems, people shift their worries to smaller ones. In the absence of small problems, they focus on petty or even imaginary ones.

Free from stressing about where their next meal will come from, worry shifts to, say, a politician being rude. Relieved of the trauma of war, stress shifts to whether someone’s language is offensive, or whether the stock market is overvalued.

Imagine a fictional society that has unlimited wealth, unlimited health, and permanent peace. Would they be overflowing with joy? Probably not. I think their defining characteristic would be how trivial and absurd their grievances would be. They’d be enraged that their maid was 10 minutes late, stressed about whether their lawn was green enough, or despondent that their child didn’t get into Harvard.

It often gives the impression that the world is getting worse when what’s changed is our definition of what counts as a problem.”

I had such an experience this past week. My favorite podcaster, Bill Simmons, who usually comes out with multiple podcasts each week, hadn’t published any in over a week. I was genuinely annoyed. What was going on? Didn’t he know that we’re in the midst of the NFL playoffs, and I needed to hear his takes and picks?

Then it dawned on me, “Oh man, Bill lives in California. He must be impacted by the wildfires.” And I immediately felt dumb for my silly complaints.

While I was concerned about how I was going to fill my time on my morning commute, hundreds of thousands of people in California were living through a horrific week of destruction.

Sometimes these big disasters can help us reset and gain perspective on what actually qualifies as a problem.

Somewhere in the range of 12,000 structures in Los Angeles County have been destroyed or damaged by the wildfires over the past couple of weeks. Estimates predict this will likely be the costliest wildfire in U.S. modern history due to the dense population and high-valued real estate in the area.

The typical home value in the L.A. metro area is about $956,000, more than double the $359,000 on the national level.

After years of rising house prices in L.A., not only are people’s whole lives wrapped up in their homes but also most of their wealth. Much of the value of the property is still in the land they own, but many who have lost their homes were expecting to use their equity as their primary source of retirement funds.

Frankly, this is true across the country. Not only is a house most people’s biggest financial asset, but for many it’s their only financial asset.

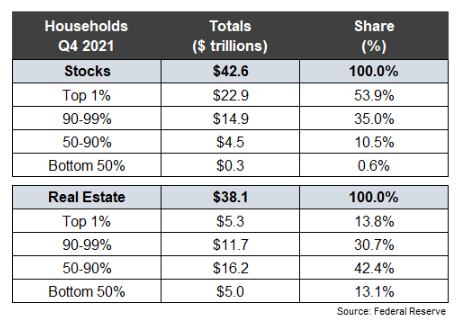

As opposed to the stock market where the top 10% of the population owns 90% of the stocks, the real estate market is far less concentrated with the bottom 90% of the population owning around 55% of the market:

When making their New Year’s Resolutions and setting their goals for 2025 just a few short weeks ago, I’m sure the residents of L.A. were not planning on their houses burning to the ground causing their entire lives to be derailed.

But that’s the thing about emergencies; they’re unexpected. Risk is what’s left over after you’ve thought of everything.

“Things that have never happened before happen all the time.” — Scott Sagan

So, given that unexpected things happen all the time, you do need to periodically check in on the boring parts of your personal finances to ensure you have some margin of safety.

Do you have adequate insurance coverage?

I know, talking about insurance is one of those plug-your-nose-and-take-your-medicine parts of financial planning. Everyone hopes they never have to use their insurance, but reviewing your life, disability, health, home, and auto insurance coverages is crucial to making sure one unfortunate event doesn’t derail years of financial progress.

Do you have an emergency fund?

Everyone should maintain at least three to six months’ worth of personal living expenses in a dedicated savings account.

Additionally, it’s valuable to have more liquid funds in a flexible brokerage or investment account that can be accessed in case of an extreme or prolonged setback.

A good financial plan should be able to survive a wide range of outcomes.

Saving doesn’t require a goal of purchasing something specific. You can and should just save for saving’s sake.

Predicting what you’ll use your savings for assumes you live in a world where you know exactly what your future expenses will be–which no one does. Saving is a hedge against life’s uncanny ability to surprise at any moment.

Thanks for reading!

Jake Elm, CFP® is a financial advisor at Dentist Advisors. Jake a graduate of Utah Valley University’s nationally ranked Personal Financial Planning program. As a financial advisor at Dentist Advisors, he provides dentists with fiduciary guidance related to investments, debt, savings, taxes, and insurance. Learn more about Jake.</em