Earlier this year I wrote quite a few posts about houses. The housing market was often on my mind because my wife and I were looking for a home to buy and house prices were increasing like crazy all across the country. However, I haven’t paid nearly as much attention to the housing market since that time.

I haven’t cared as much. We have our place to live and if the market goes up, goes down, or stays the same it doesn’t matter to me because we’re not planning on leaving anytime soon.

As an aside, I wish people had that same attitude toward investing in the stock market. It doesn’t matter if stocks are up or down in the short term if you have a long time horizon.

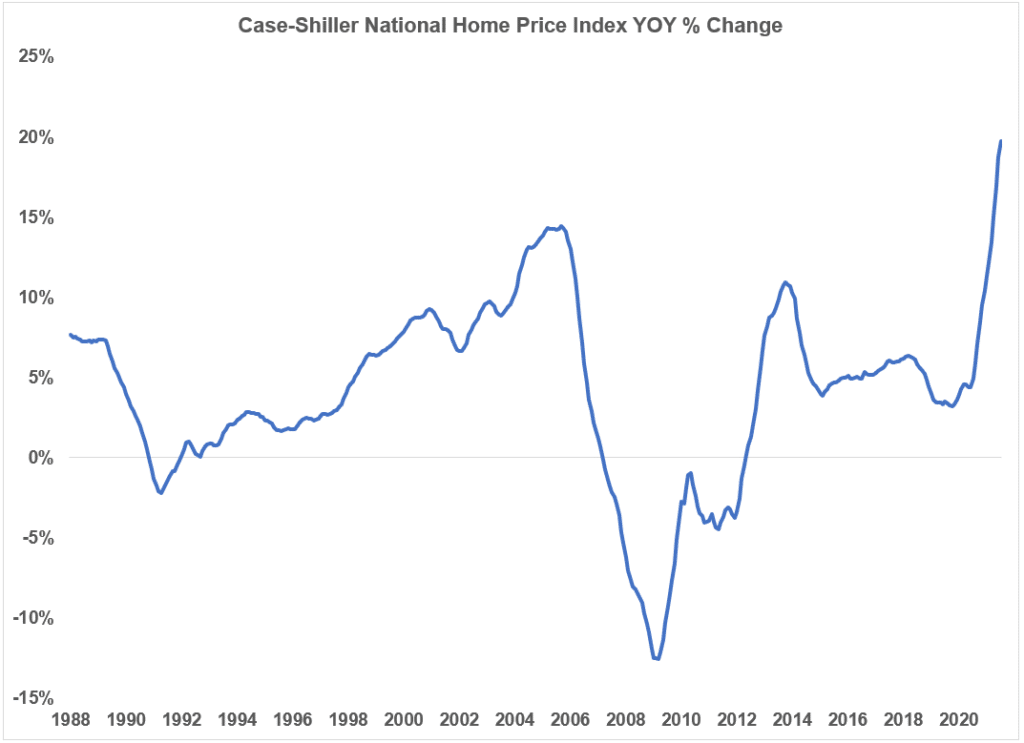

Still, house prices have continued to climb. They’re up 20% over the last year, which is the largest one-year spike in the U.S. on record.

For those looking to buy a house, this is a scary chart. It never feels great to buy something at the highest price it’s ever been.

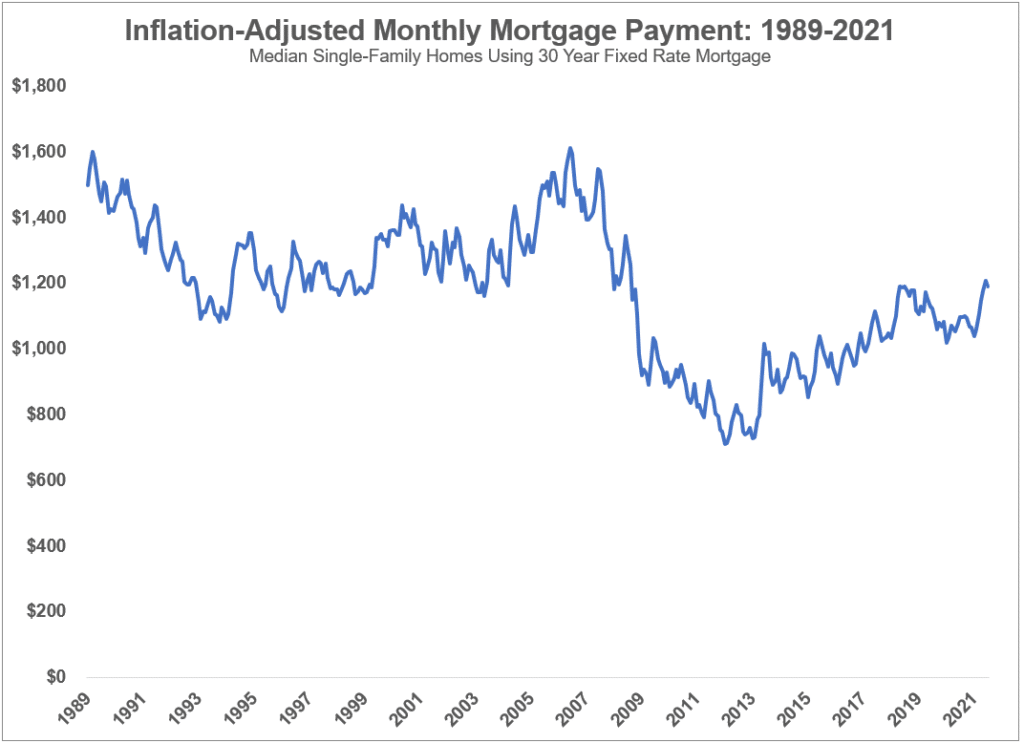

Yet, as I wrote about a few months ago, because of historically low interest rates, monthly mortgage payments actually aren’t that unaffordable. Sure, house prices have increased significantly but interest rates have also decreased significantly. The result is that after adjusting for inflation, monthly mortgage payments are still lower or equal to any time before 2008:

Adjusting for inflation, monthly mortgage payments don’t look any worse now than they have in the past.

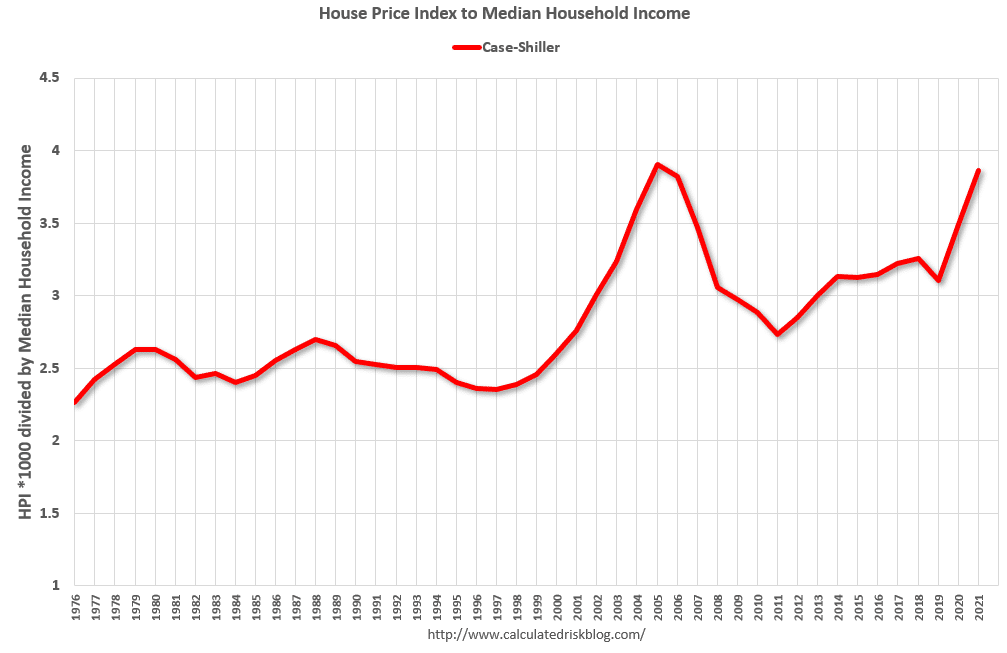

However, an important part of the affordability equation that I think I missed in my last post was comparing monthly payments to income. Median income declined 2.9% last year while the average house price increased 20%.

The Wall Street Journal published an article stating that the median American household would need 32.1% of its gross income to cover mortgage payments on a median-priced home. That is the most since November 2008, when the same outlays would eat up 34.2% of gross income.

As you can see from the following graph, monthly payments as a percentage of household income are as high as they’ve been in over a decade:

Basically, housing prices are rising much faster than incomes. The median price for a single-family home in January was $308,000. The latest data now has the median price at $367,000.

Anecdotally, I know people who are in the market for a house who have saved $15,000 to $20,000 over the course of a year, but the houses they’re looking at have increased in price by $80,000 to $100,000. After a year of diligently saving, they’re in no better position to buy a house because prices have risen so quickly.

So, are houses becoming unaffordable?

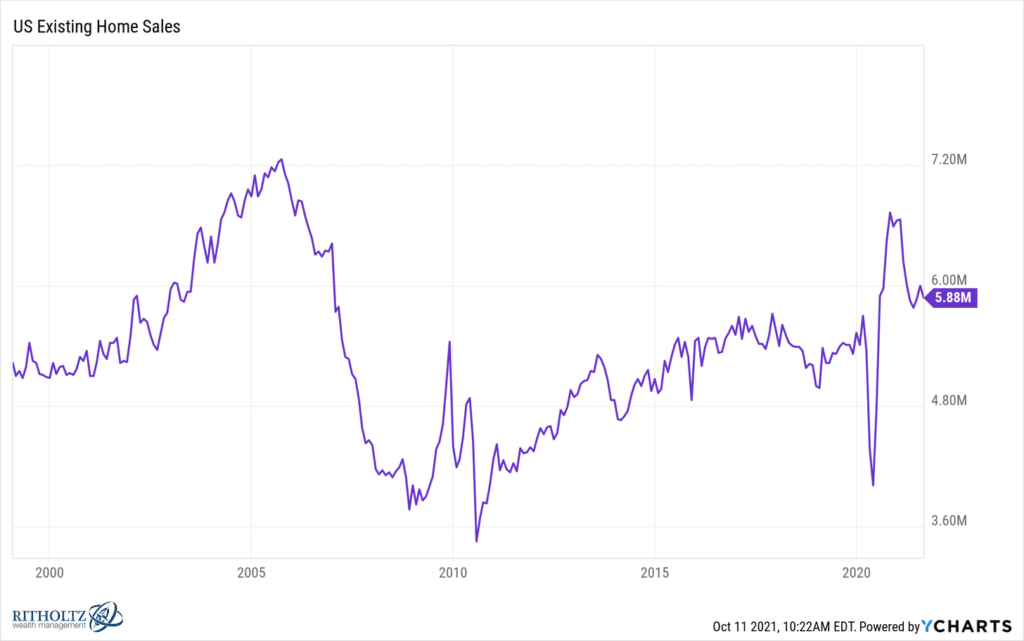

Maybe. On the one hand, prices are increasing rapidly and monthly mortgage payments as a percentage of income are as high as they’ve been in recent history. But on the other hand, there are charts like this showing a huge spike in home sales the past year:

If housing was really that unaffordable, why would there be record home sales over the past decade?

I’ve shared a lot of data (maybe too much) and I don’t think I have a firm takeaway. My conclusion is it’s difficult to look at the aggregate data and make a sweeping, general statement that “housing is this” or “housing is that.” The housing market is different in every city across the country.

There are parts of the country where buying a house is unattainable for many people right now. But that doesn’t mean it’s unaffordable for everyone everywhere. Whether you should or shouldn’t buy a house is a personal decision that’s unique for everyone.

Thanks for reading!